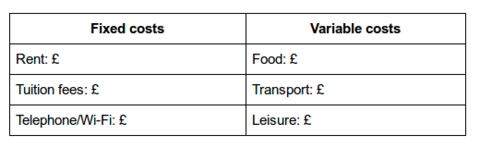

Break down your expenses

The first thing to do is estimate how much studying in the UK is going to cost you. Create an overview of your fixed costs (rent, tuition fee, phone bill, etc.) and your variable costs, (food, transport, trips, shopping etc.), and set aside an amount for unforeseen circumstances. (if something breaks, if you lose something, etc.). Sticking to your overview to the penny isn’t going to happen, but having it will give you some peace of mind and make it a lot easier to manage your cash.

Choosing a student account

Banks in the UK will try their best to get students to open an account with them, but make sure you do your homework before going with the first bank you find. Avoid being swayed by free gifts, and only take out that interest-free overdraft if you need it.

You’ll typically need to wait until you arrive in the UK and have an address before you can open your account, which can mean waiting for weeks or even months. That’s not very convenient for international students, so we checked out the alternatives. We found out that UniZest have created the Aspire Account , which you can open before you even leave for the UK or have an address there. It works just like a bank account, with a few extra benefits perfect for international students in the UK, like a money management service and an integrated ForEx service.

When transferring money, think ahead

Transferring money internationally can be expensive, and can take days to arrive. If possible, think ahead to how much you’ll need over the coming months and transfer it all at once. This will avoid you having to pay multiple service charges, which can add up pretty quickly.

Wait to buy your textbooks

Textbooks can cost a small fortune, and there’s nothing worse than spending a lot of money on something you might only need once. Check whether your university library has the books you need, and ask your lecturers how often you’ll be using your textbooks throughout the year.

Sharing is caring!

Think outside the box when coming up with ways to save money! If you're living with others, consider setting up a kitty, with everyone contributing every week. As little as £10 a week each goes towards all the toilet paper and cleaning products you’ll need!

If you’re feeling particularly social, you can even suggest setting up a cooking schedule for the week - you’ll be amazed at how much money you can save by not cooking individual meals.

Be app-savvy

There are a lot of (free!) apps that can help you manage your money. Settle Up is a great one for students, which lets you make a group with your friends which keeps track of all your shared expenses. You can also check out various coupon apps to get those quick savings. And if you do go with the Aspire Account, remember to make good use of their money management tool as well.

And of course, enjoy your time in the UK

Studying in the UK isn’t all about fretting over how much money you’re spending, but by being a little careful you’ll have a bit extra to go and explore your new home. The UK is home to great cities, amazing landscapes, and of course fantastic student parties. Manage your cash wisely and make the most of your student days!